The Butler is a bullish trend reversal off a 9ema rejection and should signal support of the 9ema and move for a leg higher. This setup provides a support zone below entry that acts as a stop and invalidates the trade. A bullish reversal with support provides a solid Risk:Reward ratio(R:R) on these setups. Typically traded on the 5-minute chart, The Butler is also valid on other timeframes.

The Setup

- The Butler starts with the 9ema flipping or holding as resistance.

- Once the 9ema is established resistance, look for a strong rejection off the 9, to the downside.

- Increasing volume is a plus, and adds to conviction, but not required.

- A bullish reversal pattern at lows.

- Hammer, doji, tweezer, abandon baby, engulfing, etc. are all acceptable patterns

- Retest and reclaim of the 9ema.

- Commonly followed by a small move higher

- Retest and hold of the 9ema.

- The retest and hold should form/hold a Support Zone below.

- Entry on the 2nd retest and hold of the 9ema.

- Stop can be set at low of the mover or the bottom of the 1st 9ema retest. A close at/below those levels invalidates the 9ema retest and the trade.

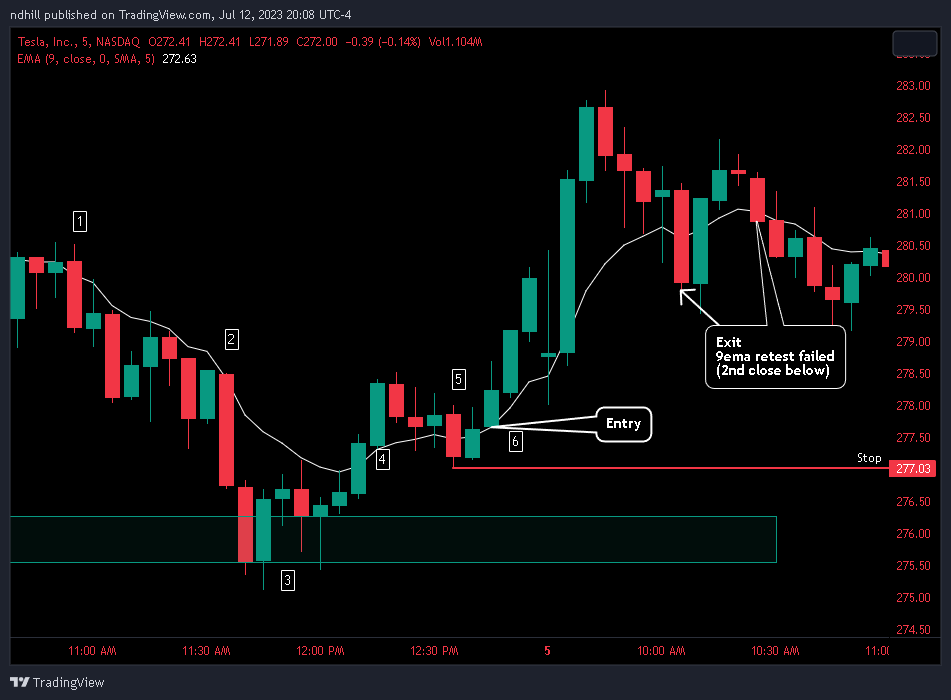

Example 1 - AMD

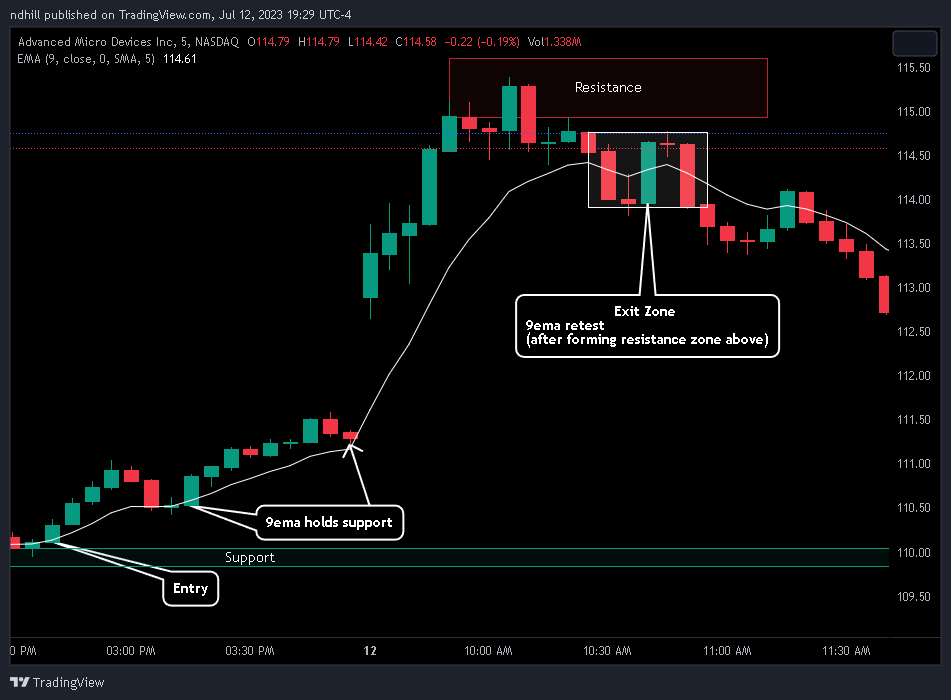

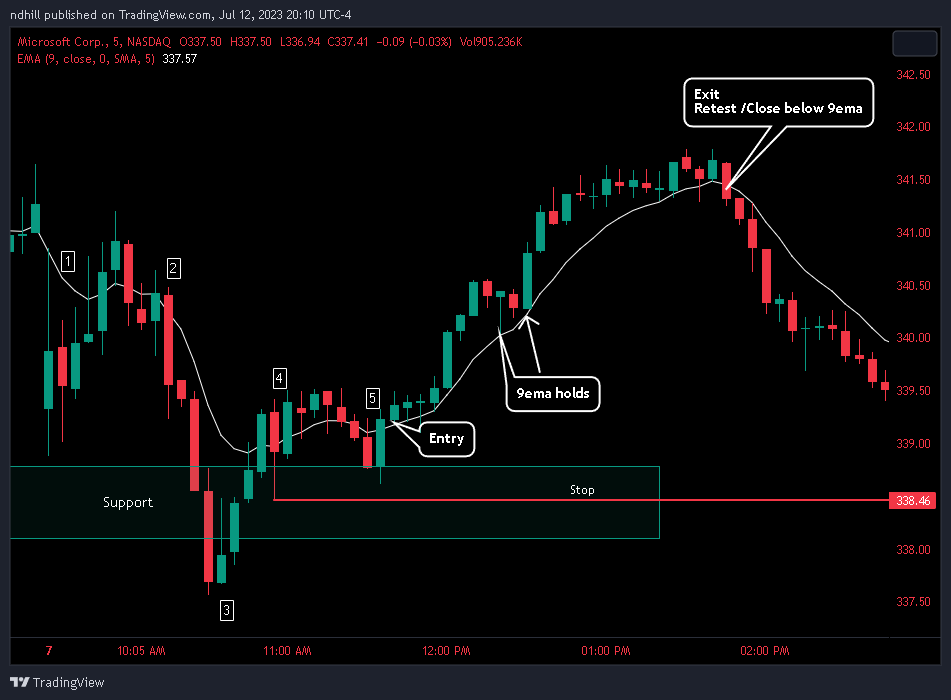

When exiting the position, look for a test and fail of the 9ema, after forming a resistance zone above. Determining the correct exit depends on a number of factors including, news, market conditions, volume, and overall volatility.

Example 2 - MSFT

Example 2 - MSFT

Example 3 - TSLA

Example 3 - TSLA