In the dynamic world of stock trading, the ability to make informed decisions swiftly is paramount. This is where real-time option flow trading comes into play, a technique that has revolutionized the way traders analyze and respond to market movements. Our guide, “The Trader’s Guide to Mastering Real-Time Option Flows and Unusual Market Signals,” is designed to lead you through the intricate maze of option trading, illuminated by the latest tools and strategies.

At the heart of this trading technique lies the concept of ‘option flow,’ which refers to the tracking of option trading volume and activity to predict future stock movements. By understanding option flows, traders can gain insights into institutional investments and market sentiments, offering a significant edge in the fast-paced trading environment. Additionally, tools like heat maps from Unusual Whales and the comprehensive data from BlackBox Stocks provide real-time insights, making it easier for traders to identify potential opportunities and risks.

This guide is structured to walk you through each aspect of real-time option flow trading. From the basics of understanding option flows to the nuanced use of advanced tools like BlackBox Stocks and Unusual Whales, we cover it all. We will also delve into practical strategies for incorporating this data into your trading decisions and share case studies to illustrate these concepts in action.

Whether you’re a seasoned trader or just starting, this guide promises to enhance your understanding and skills in navigating the complex but rewarding world of option flow trading.

Understanding Real-Time Option Flow

Real-time option flow trading is a powerful strategy in the stock market, offering insights that go beyond traditional stock trading methods. At its core, it involves the analysis of options data as it happens, providing a real-time snapshot of investor sentiment and potential market moves.

The Basis of Option Flow

Option flow refer to the buying and selling activity of options in the market. This data, when analyzed correctly, can reveal significant trading patterns. For instance, a sudden surge in call option purchases for a particular stock might indicate an upcoming positive move in that stock’s price.

Why Real-Time Data Matters

In fast-paced markets, timing is crucial. Real-time option flow data gives traders the ability to react instantaneously to market changes. This is in stark contrast to end-of-day data, which only provides insights after the market has closed, potentially missing crucial trading opportunities.

Identifying Market Trends

Real-time option flow allows traders to identify both broad market trends and specific stock movements. By analyzing the volume, open interest, and price of options, traders can gauge market sentiment and predict potential price movements in underlying stocks.

Institutional Movements

Institutional investors often deal in large volumes, and their trading activities can significantly influence market directions. Live options flow data provides visibility into these large-scale movements, offering an insight into the strategies of big players in the market.

Sentiment Analysis

Options flow can be a powerful indicator of market sentiment. For instance, a high volume of put options might indicate bearish sentiment, suggesting that traders expect the market to decline. Conversely, a spike in call options can signal bullish sentiment.

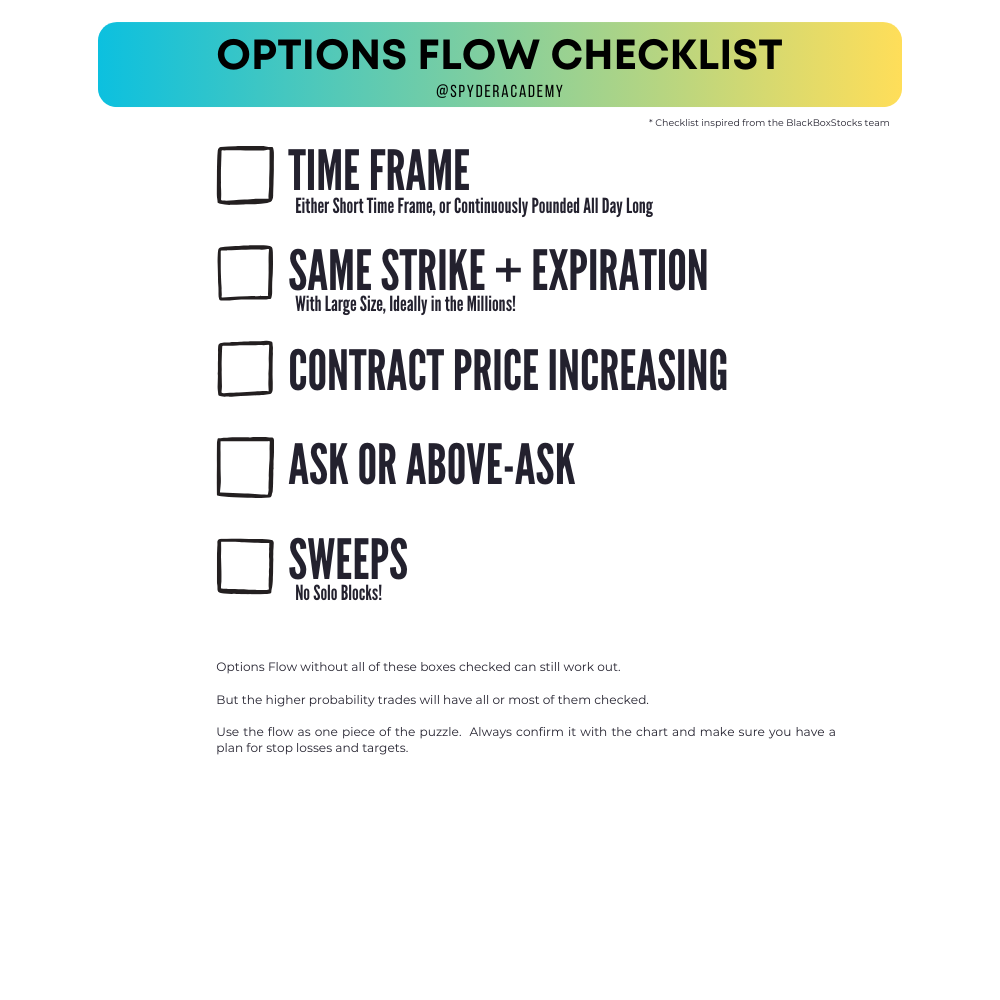

How to read Options Flow

Reading options flow involves looking at several key factors:

-

Volume: Start by examining the volume of options contracts traded. Unusually high volume compared to the stock’s average can be a sign of interest.

-

Strike Prices: Pay attention to the strike prices of the options being traded. Are they near the current stock price (at-the-money), or are they significantly out-of-the-money or in-the-money?

-

Expiration Dates: Look at the expiration dates of the options. Are traders targeting short-term or longer-term movements?

-

Call vs. Put Options: Determine whether traders are buying more call options (bullish) or put options (bearish). This can provide insight into market sentiment.

-

Block Trades: Keep an eye out for block trades, which involve significant amounts of options contracts being bought or sold at once. These can be particularly meaningful. But a block trade by itself can be deceptive. Ideally you want it surrounded by a number of Sweeps.

-

Sweep Trades: Sweep trades indicate aggressiveness in buying. Fill my order and get it from whatever exchange you can, breaking the trade up into multiple orders. Block trades are less aggressive as it asks for the order to be filled entirely at once, or dont fill at all, and are usually privately negotiated between the buyer and seller. Multiple sweeps over a short period of time adds an additional layer of confirmation for the flow.

-

Follow the Money: If a large institution with a successful track record is making significant options trades, it may be worth paying extra attention.

Tools for Tracking Real-Time Options Flow

The landscape of live options flow tracking is rich with various tools, each offering unique features and insights. Understanding and choosing the right tools is crucial for any trader looking to leverage the power of options flow data.

Variety of Tools Available

The market offers a range of tools for tracking real-time options flow. These tools vary in complexity, data presentation, and additional features. From sophisticated software platforms to user-friendly mobile apps, traders have a plethora of options to choose from.

Key Features of Tracking Tools

When selecting a tool for options flow tracking, consider the following features:

- Speed and Real-Time Data: Ensure the tool provides real-time data without significant delays.

- Data Accuracy and Reliability: The data should be accurate and come from reputable sources.

- User Interface: A user-friendly interface can significantly enhance the trading experience.

- Type of Data Provided: Look for tools that provide comprehensive data, including volume, price, and open interest.

- Cost and Subscription Models: Balance the cost of the tool with the features and benefits it offers.

Popular Tools in the Market

Some of the popular tools in the market include:

- Unusual Whales: Known for its heat maps and intuitive interface, it’s great for visualizing large data sets.

- Black-Box Stocks: Offers a range of features including live alerts, advanced filtering, and a community chat room.

Integrating Tools into Trading Strategy

Select tools that align with your trading strategy. For example, if you’re focused on short-term movements, a tool with real-time alerts and quick data updates is essential. Long-term traders might prefer tools with extensive historical data and trend analysis features.

Analyzing Unusual Whales Heat Maps

Unusual Whales has become a go-to tool for many traders, particularly for its innovative heat map feature. This powerful tool visualizes the live options flow, making it easier to spot trends and anomalies in the market.

Understanding Heat Maps

Heat maps by Unusual Whales provide a visual representation of options market activity. Different colors on the map indicate varying levels of activity, with warmer colors typically representing higher levels of trading volume or significant price movements.

Key Components of the Heat Map

- Color Coding: Each color signifies a specific level of activity or trend in the options market.

- Labels and Indicators: The map includes labels for call and put options, volumes, strike prices, and expiration dates.

- Interpreting Data: Traders can quickly assess which options are attracting the most attention, indicating potential market moves.

Advantages of Using Heat Maps

- Quick Analysis: Heat maps allow for rapid identification of market trends.

- Pattern Recognition: Traders can spot patterns over time, aiding in prediction and strategy formulation.

- User-Friendly: The visual nature makes it accessible even to those new to options trading.

Applying Heat Map Data in Trading

- Identifying Opportunities: Look for unusual activity, such as a sudden increase in call or put options volume.

- Risk Management: Heat maps can also reveal potential risks, helping traders avoid certain options with unfavorable trends.

Limitations to Consider

While heat maps are a powerful tool, they should be used in conjunction with other research and analysis methods. Relying solely on visual data can sometimes lead to misinterpretation.

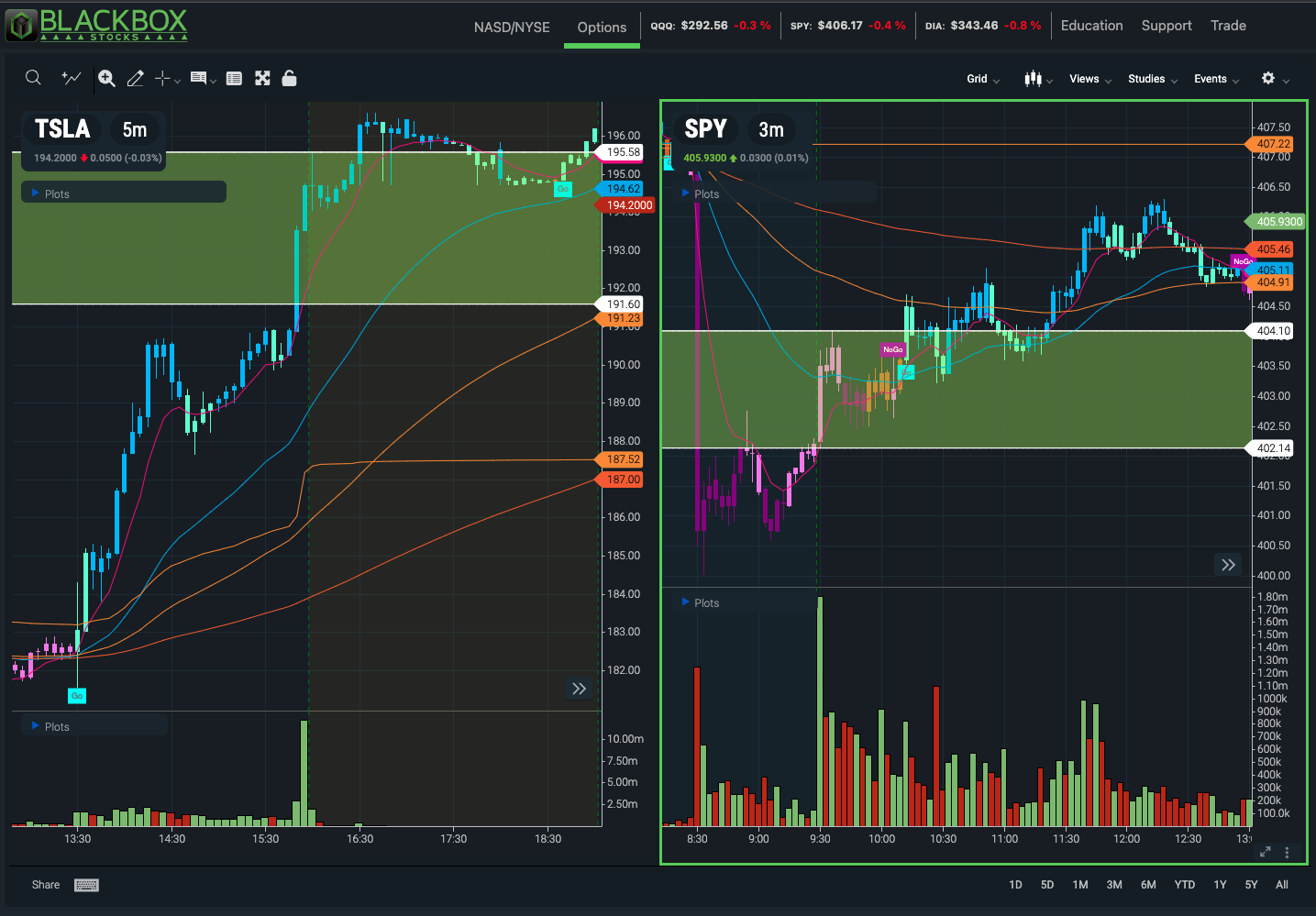

Exploring BlackBox Stocks for Options Flow

Black-Box Stocks is a significant player in the realm of options trading tools, known for its comprehensive approach to market analysis and real-time data tracking. This section explores how traders can utilize this platform to enhance their trading strategies.

Overview of BlackBox Stocks

Black-Box Stocks offers a robust platform that includes real-time options flow data, stock screener tools, and a community chat room. It’s particularly favored for its detailed analytics and user-friendly interface.

Features of BlackBox Stocks

- Real-Time Options Flow Tracking: The platform provides up-to-the-minute data on options trading activities, including volumes, strike prices, and expirations.

- Advanced Analytics: BlackBox Stocks offers a range of analytical tools to help traders make informed decisions.

- Customizable Alerts: Traders can set up alerts based on specific criteria, ensuring they don’t miss critical market movements.

Using BlackBox Stocks for Trading

- Strategy Formulation: By analyzing the flow data, traders can develop strategies based on current market trends.

- Risk Assessment: The platform’s analytics help in assessing potential risks in various options trades.

- Community Insight: The integrated chat room allows for the exchange of ideas and strategies among traders.

- Trading Charts: The integrated charting platform provides a one stop shop to analyze chart patterns and trade setups alongside options flow and other black box stock alerts.

Tips for Maximizing Benefits

- Customization: Utilize the platform’s customization features to tailor the data presentation to your specific trading style.

- Continual Learning: Engage with the community and use the platform’s educational resources to stay updated on trading strategies.

Limitations and Considerations

While Black-Box Stocks is a powerful tool, it’s important to use it as part of a broader trading strategy. Relying solely on one tool or data source can limit the understanding of the market.

Comparison: BlackBox Stocks vs. Unusual Whales

When it comes to options flow trading tools, BlackBox Stocks and Unusual Whales are among the top contenders. Each platform has its unique features and strengths, making them valuable in different trading scenarios.

Data Accuracy and Reliability

- BlackBox Stocks: Known for its precise and reliable data, which is crucial for informed trading decisions.

- Unusual Whales: Also provides accurate data, with a focus on visual representation through heat maps.

Speed of Data

- BlackBox Stocks: Offers real-time data, allowing traders to react quickly to market changes.

- Unusual Whales: Similarly provides real-time data, with an emphasis on the immediacy of visual trends.

User Interface

- BlackBox Stocks: Features a user-friendly and customizable interface.

- Unusual Whales: Praised for its intuitive and visually appealing interface, especially the heat maps.

Cost Considerations

- BlackBox Stocks: Generally has a higher subscription cost, reflecting its comprehensive features.

- Unusual Whales: Offers a more affordable option, making it accessible to a broader range of traders.

Unique Features

- BlackBox Stocks: Known for its advanced analytics and customizable alerts.

- Unusual Whales: Stands out for its unique heat map feature, providing an easy-to-understand visual of market trends.

Which One to Choose?

The choice between Black-Box Stocks and Unusual Whales depends on individual trading needs and preferences. If you prioritize advanced analytics and customizable features, BlackBox Stocks might be the better option. However, if you prefer visual data representation and affordability, Unusual Whales could be more suitable.

Strategies for Using Option Flow Data in Trading Decisions

Utilizing option flow data effectively is crucial for traders looking to gain an edge in the market.

This section explores various strategies to integrate this data into trading decisions.

1. Identifying Entry and Exit Points

- Spotting Volume Spikes: High volumes in options can signal an impending price movement in the underlying stock.

- Options Expiration Dates: Pay attention to the expiration dates; significant activity near expiration can indicate market expectations.

2. Sentiment Analysis

- Bullish vs. Bearish Signals: A surge in call options can indicate bullish sentiment, while an increase in put options might suggest bearish sentiment.

- Institutional Investor Activity: Large trades by institutional investors can provide insights into market direction.

3. Risk Management

- Hedging Strategies: Use option flow data to identify potential risks in the market and hedge your positions accordingly.

- Diversification: Analyze the flow data across different sectors to diversify your investment portfolio.

4. Trend Following and Contrarian Strategies

- Following the Flow: Align your trades with the dominant trends identified in the option flows.

- Contrarian Approach: Look for opportunities where the option flow data diverges from the general market sentiment.

5. Combining with Technical Analysis

- Correlating with Chart Patterns: Use option flow data in conjunction with chart patterns for a more comprehensive market analysis.

- Volume and Price Movements: Cross-reference the data with volume and price movements of the underlying stocks.

Case Studies and Success Stories

The true value of real-time option flow data is best illustrated through real-world success stories and case studies. This section highlights a few such instances, demonstrating how strategic use of option flow data can lead to significant trading victories.

Case Study 1: Spotting Market Trends

A trader noticed a consistent increase in call option volumes for a particular tech stock. By aligning their trade with this bullish sentiment, they capitalized on a subsequent stock price surge, resulting in substantial profits.

Case Study 2: Contrarian Strategy

In another instance, a trader observed a heavy influx of put options in a seemingly strong market. Taking a contrarian approach, they shorted the market just before a major correction, leading to a profitable outcome.

Success Story: Risk Management

A seasoned trader used option flow data to identify potential risks in their portfolio. By adjusting their positions in response to unusual put option activity, they effectively mitigated losses during a sudden market downturn.

Learning from Successes

These cases underscore the importance of:

- Continuous Monitoring: Keeping a constant watch on option flow data for potential trading signals.

- Strategic Flexibility: Being adaptable in trading strategies based on the data analysis.

- Risk Awareness: Using option flow data as a tool for risk assessment and management.

The Road to Success

While these stories highlight the potential of using option flow data, it’s crucial to remember that successful trading requires a combination of data analysis, experience, and sometimes, a bit of luck.

The world of option flow trading is both complex and rewarding, offering traders a unique lens through which to view market dynamics. As we’ve explored in this guide, tools like BlackBox Stocks and Unusual Whales provide invaluable insights into real-time options flow, allowing traders to make more informed decisions.

Understanding and interpreting option flow data, whether through heat maps or advanced analytics, can be a game-changer in developing effective trading strategies. From identifying market trends and sentiment to managing risks and capitalizing on opportunities, the potential benefits are immense. However, it’s essential to remember that no tool or data source is infallible. A balanced approach, combining option flow data with other market analysis and sound trading principles, is key to long-term success.

As demonstrated by the case studies and success stories, the strategic application of real-time option flow data can lead to significant trading victories. Yet, these successes are not just the result of access to data; they come from the trader’s ability to interpret and act on this information effectively.

Whether you are a novice or an experienced trader, embracing the power of real-time option flows and the tools available can significantly enhance your trading acumen.

Stay informed, stay adaptable, and let the data guide your path to trading success.