The SORBET strategy combines two already great strategies - Opening Range Breakout (ORB) Strategy, and The System Strategy, to give consistent A+ setups.

The System dictates the directional trend of the higher time frame chart, while the ORB Strategy dictates when you should enter and exit a trade based on the ORB levels set in the first 15 minutes of the day.

When you combine the two strategies, you end up taking Opening Range Breakout trades in the direction of the higher time frame trends, thus giving you a significantly higher probability of being in the right direction.

The SORBET Strategy works best on SPX/SPY and TSLA.

WHY THE SORBET STRATEGY?

PATIENCE

Patience is key for being a successful day trader. For me, SORBET’s clear rules for when to enter a trade allows me to patiently wait for that setup to occur. If I don’t get it, then I may not even make a trade that day. Other days I get the setup early on in the morning and I am done trading by 11am ET. As I have traded SORBET for many months now, I’ve come to realize that I am most successful when I wait for the set up.

CUTS THE NOISE

SORBET has clear rules on when to enter trades, and more importantly - when to sit on hands. When the ticker is trading inside the chop zone, I know not to trade. I have watched others attempt to trade in this zone and get chopped out time and time again. Because of SORBET’s clear mantra of “Don’t Trade In The Chop Zone!”, I can simply cut out all the noise from other traders during that time.

And because I focus on just this one strategy, and have consistently made money from it, it enables me to start to ignore alerts that other traders send out. It’s having the consistent simple strategy and framework that allows me to stop playing other peoples games and chasing their alerts, and instead have the confidence to focus on my own game.

CLEAR RULES

SORBET’s clear rules of when not to trade (inside the chopzone), and when to be long vs short allows you to be stubborn about what trades to take. That increases the quality of your trading. It reduces the mental fatigue of why you should enter a trade based on strategy A, B, C, or D. Its just one strategy you have to think about. The rules by nature make your entries an A+ setup. eg “Go Long Above The Cloud and Above ORB range” - means you have a trend (The System Cloud), you broke through a key resistance level (ORB High), and you aren’t fading a higher timeframe trend. It is super easy to visually see on the chart also.

WORKS IN BULL, BEAR, AND SIDEWAYS MARKETS

While I was learning and experimenting with a variety of strategies in 2022, I found some strategies only worked in Bull Markets. Others only on strong trend days because they relied on low time frame moving averages, but would do poorly on chop days and by the time you realize its a chop day you already lost 2-3 trades.

SORBET tells you when its choppy, so you sit on hands and don’t trade. If that saves you from making losing trades when the risk isn’t worth it - then that is a big win, and gets you far on the road to maturity as a trader. Then when you have a strong trend in the market (Bear or Bull), the System SMA’s will tell you about the trend and you trade with the market. This allowed us to short the hell out of TSLA back in Dec 2022 when it had a strong down trend. It also helped us get long again on its rally back up in Jan 2023. And allowed us to avoid trading (or size down) when the markets trended sideways around SPY 400.

HOW DOES SORBET WORK?

THE SYSTEM CLOUD

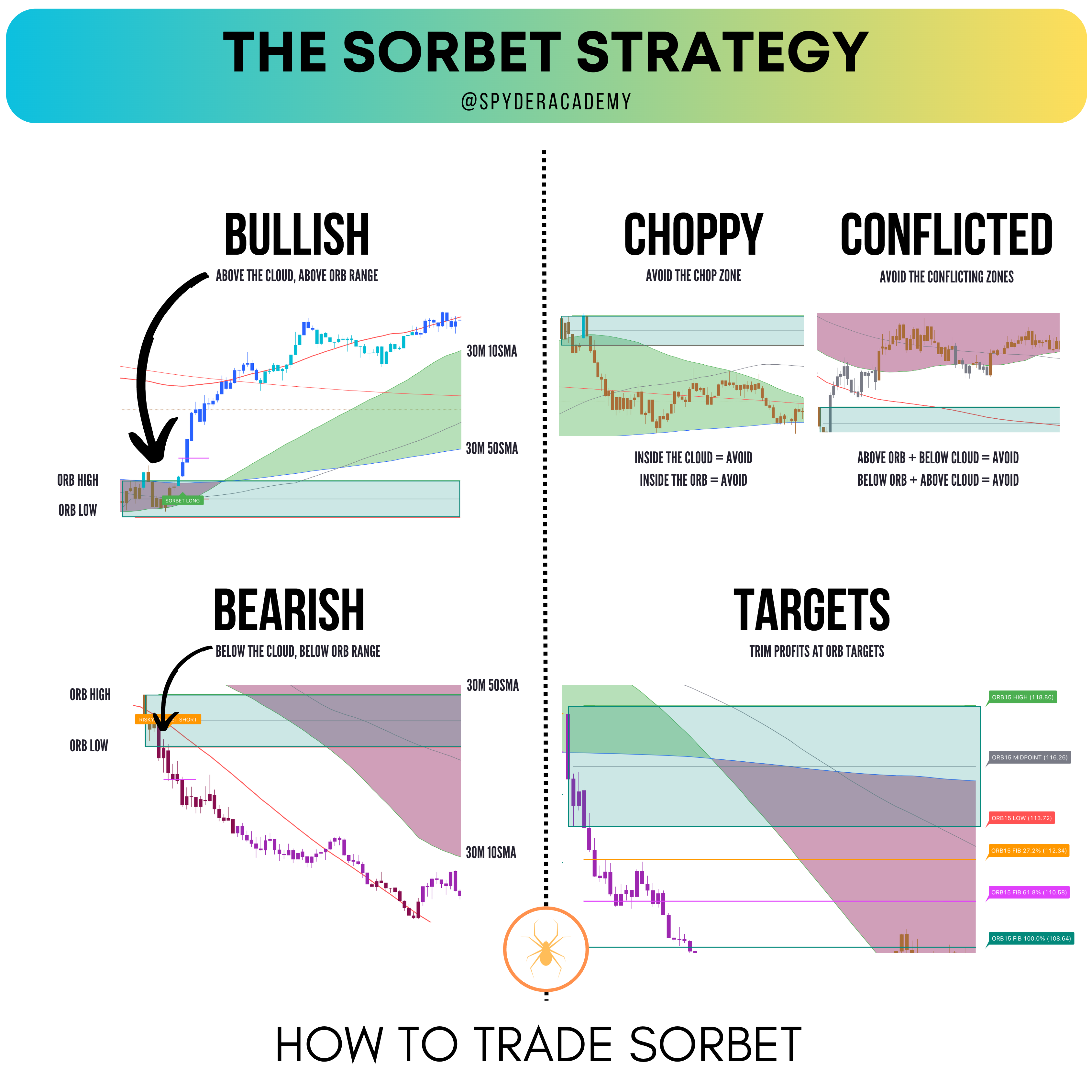

The first part of SORBET is The System (created by Trader Brian Jones). It combines the 10sma and 50sma from the 30 minute chart to give you a higher timeframe trend. If the 30min 10sma crosses below the 30m 50sma, it is bearish. If the 30min 10sma crosses above the 30min 50sma, it is bullish.

Generally, that means if you are trading above the 10/50sma cloud on the 30min timeframe, you want to get long. If you are trading below the 10/50sma cloud, you want to get short.

THE OPENING RANGE BREAKOUT

The second part of SORBET is the ORB Strategy. The Opening Range Breakout (ORB) Strategy works by taking the high and low of the first 15 minutes of regular session (so 9:30am - 9:45am ET). After 9:45am, if price breaks and holds above the ORB High level, then that is a Bullish move, and you want to look for longs. Likewise, if price breaks and holds below the ORB Low Level, then that is a Bearish move, and you want to look for shorts.

SORBET - THE A+ STRATEGY

SORBET becomes an A+ strategy when you combine the above two concepts. The higher timeframe trend from The System tells you the way the market is moving. While the ORB tells you the way the market wants to move on the particular day. When both of these align, you get a higher conviction trade in the direction of the trend. So, get long when above the cloud AND above ORB. Get short when below the cloud AND below ORB. Avoid trading while inside the ORB range and inside the System Cloud.

I used to trade the Opening Range Breakout (ORB) Strategy alone (before I learned about The System), and my biggest frustration was getting the fake breakouts, or getting chopped up on sideways days where the ORB levels would break, but there would be no continuation. Once I learned about The System, I was able to avoid chop days, and move the probability of winning trades in my direction by trading the trend.

SORBET - THE SYSTEM + ORB ENTRY POINTS

This strategy combines my two favorite techniques - ORB and The System. Learn more about the Opening Range Breakout strategy to find Entries and Exits. By combining these two strategies, you can reduce the amount of fakeouts by determine the larger timeframe bias given by The System, with optimal day trading entries and exits using ORB.

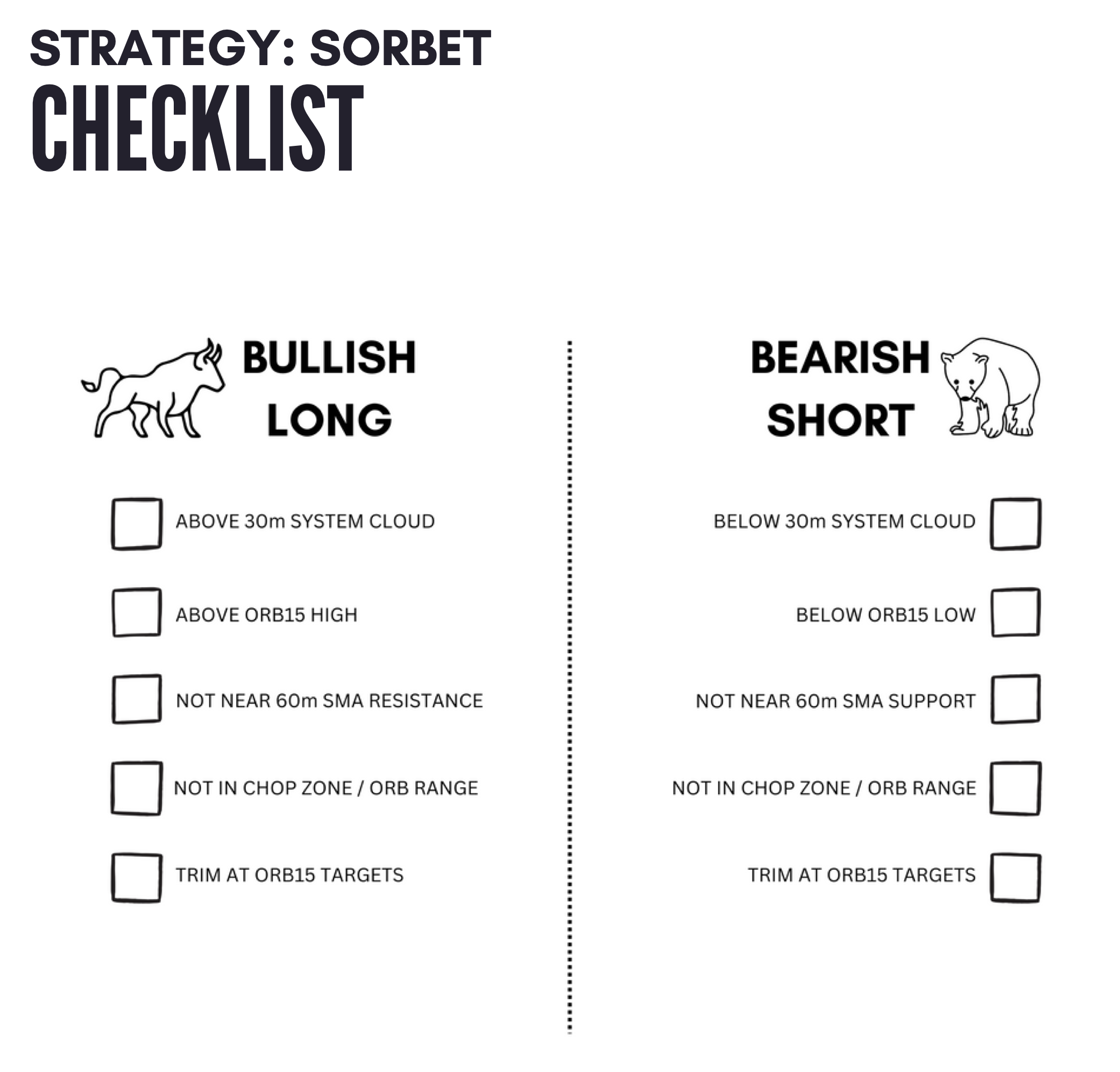

The following SORBET checklist is provided as an easy printout to confirm the rules have been met when taking an entry based on SORBET.