Trading in the financial markets demands both precision and strategy. One intriguing method that traders have adopted is the “Saty ATR” strategy, named after its unique approach based on Average True Range (ATR) levels. In this guide, we’ll delve into the intricacies of trading with Saty ATR and introduce you to a variation known as “The Golden Gate” that can enhance your trading results.

Understanding Saty ATR Strategy

The Saty ATR strategy relies on ATR, a volatility indicator that measures market movement. Specifically, it calculates the average range between high and low prices over a defined period. In this case, we use a 14-day ATR.

Core Elements of Saty ATR

1. ATR Calculation: A key component of the Saty ATR strategy is the calculation of the ATR for a given trading instrument. This indicator provides insights into market volatility, helping traders gauge potential price movements.

2. Trigger Levels: Saty ATR employs trigger levels based on the prior day’s close price. These levels are determined by adding or subtracting a specific percentage of the 14-day ATR. The trigger levels act as critical reference points for trading decisions.

3. Call and Put Triggers: Traders use these trigger levels to identify entry and exit points for Call (buy) and Put (sell) positions. A break above the upper trigger can signal a Call opportunity, while a break below the lower trigger can indicate a Put opportunity.

4. Fib Extensions: Fibonacci extensions are then plotted from these ATR levels. These extensions provide additional reference points for traders and are instrumental in decision-making.

The SATY ATR indicator is available for free by Saty at Satyland.com for both TradingView and ThinkOrSwim.

The SATY Pivot Ribbon

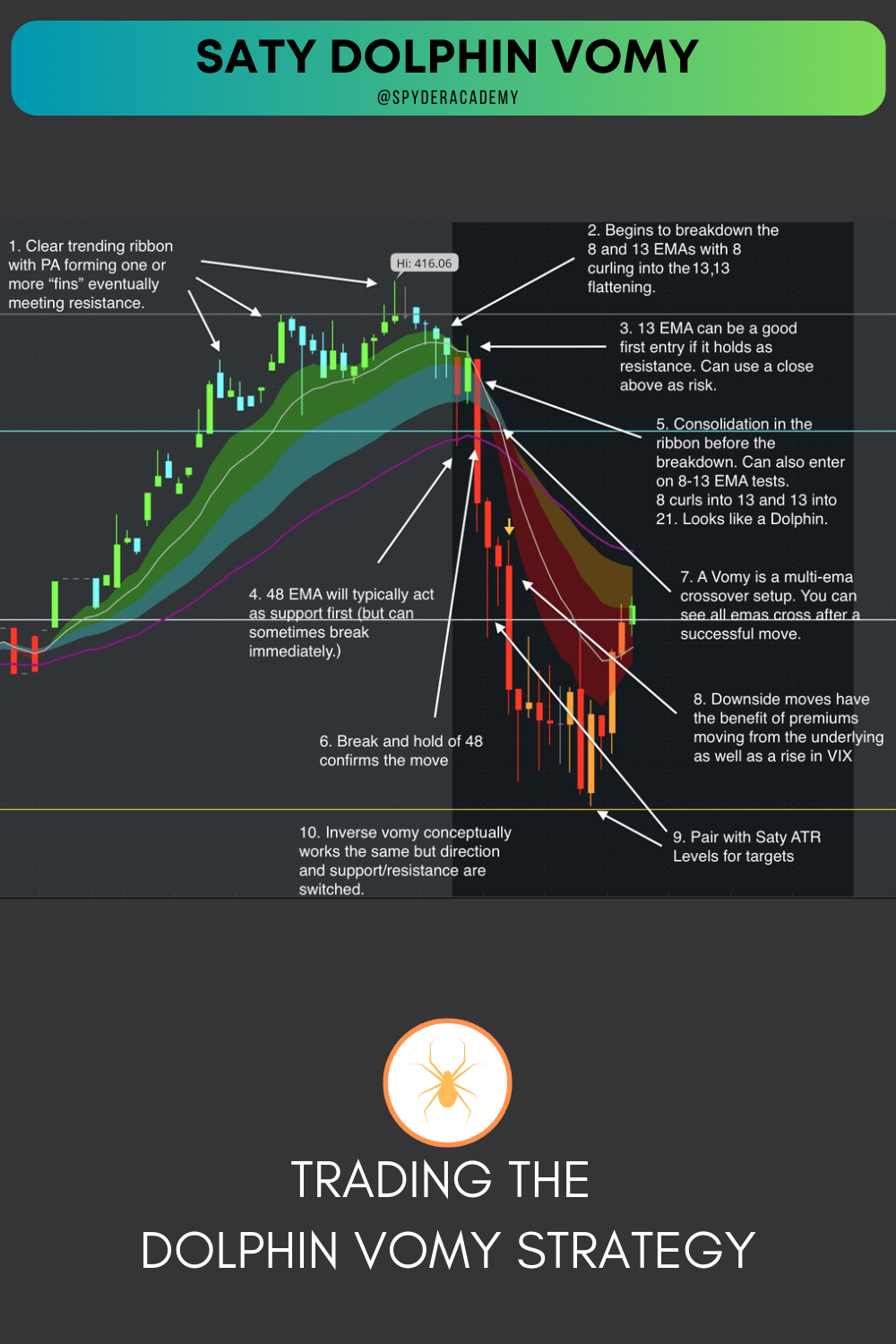

The Saty ATR strategy can be combined with the Saty Ribbon which utilizes the 8/21/34 EMA’s to draw a Ripster style ribbon. The 13/48 ema’s are further used for added conviction. Furthermore, a timewarp feature is available to view a ribbon from the 10m timeframe on a lower timeframe.

When the ribbon shows a clear trend, and the ATR levels are crossed, you have added conviction to trade the levels with the trend.

An example of a high performing strategy using the Saty Pivot Ribbons can be found with the Dolphin Vomy Strategy.

The Golden Gate: A Saty ATR Variation

One notable variation of the Saty ATR strategy is known as “The Golden Gate.” This variation introduces a powerful concept for traders to consider.

The Golden Gate Principle: When trading with Saty ATR, pay close attention to the 38.2% level. Known as the “golden gate,” crossing this level often indicates a high probability of reaching the 61.8% level, referred to as the “golden fib.”

This principle suggests that once the price crosses the 38.2% level, there is a significant chance that it will continue its movement to reach the 61.8% level. Traders can use this insight to fine-tune their entry and exit strategies, potentially maximizing their gains.

Trading with Saty ATR in Practice

Trading with the Saty ATR strategy involves patience and precision. Traders typically monitor the 3-minute (3m) chart, waiting for price breaks of the predefined ATR levels. Once a level is breached, traders may consider entering a position and then trim their positions at subsequent ATR levels as the price progresses.

Conclusion

The Saty ATR strategy, with its foundation in ATR levels and trigger points, offers traders a systematic approach to navigate the complexities of financial markets. Moreover, “The Golden Gate” variation adds an intriguing dimension to this strategy, potentially increasing the chances of favorable outcomes.

As with any trading strategy, it’s essential to practice risk management and use the Saty ATR strategy alongside other technical and fundamental analysis tools. By mastering the Saty ATR strategy and understanding “The Golden Gate” principle, traders can enhance their decision-making and potentially unlock trading success.

Remember, successful trading takes practice and continuous learning. Incorporate Saty ATR into your trading toolkit, and adapt it to your unique trading style for the best results.

Start your journey with Saty ATR today and embark on a path toward more informed and profitable trading decisions.