Getting Started with Day Trading

Embarking on the journey into the stock market can be both exhilarating and daunting. For beginners, understanding the basics of the stock market is the first step towards successful investing and trading. In this guide, we’ll focus particularly on Day Trading, a popular but challenging aspect of the financial markets.

What is Day Trading?

Day Trading involves buying and selling stocks within the same trading day. Traders capitalize on small price movements in highly liquid stocks, aiming to make quick profits. Unlike traditional investing, day traders do not hold positions overnight, making this a fast-paced and potentially rewarding practice.

Why Day Trading Appeals to Beginners

- Immediate Results: Day trading offers immediate outcomes, unlike long-term investments.

- Flexibility: It allows traders to work on their own schedule and react in real-time to market changes.

- Potential for Quick Profits: Though risky, successful day trading can lead to quick profits.

The Basics of Day Trading

Before diving into day trading, it’s crucial to understand its fundamentals:

- Market Research: Successful day traders spend hours researching market trends and news that could affect stock prices.

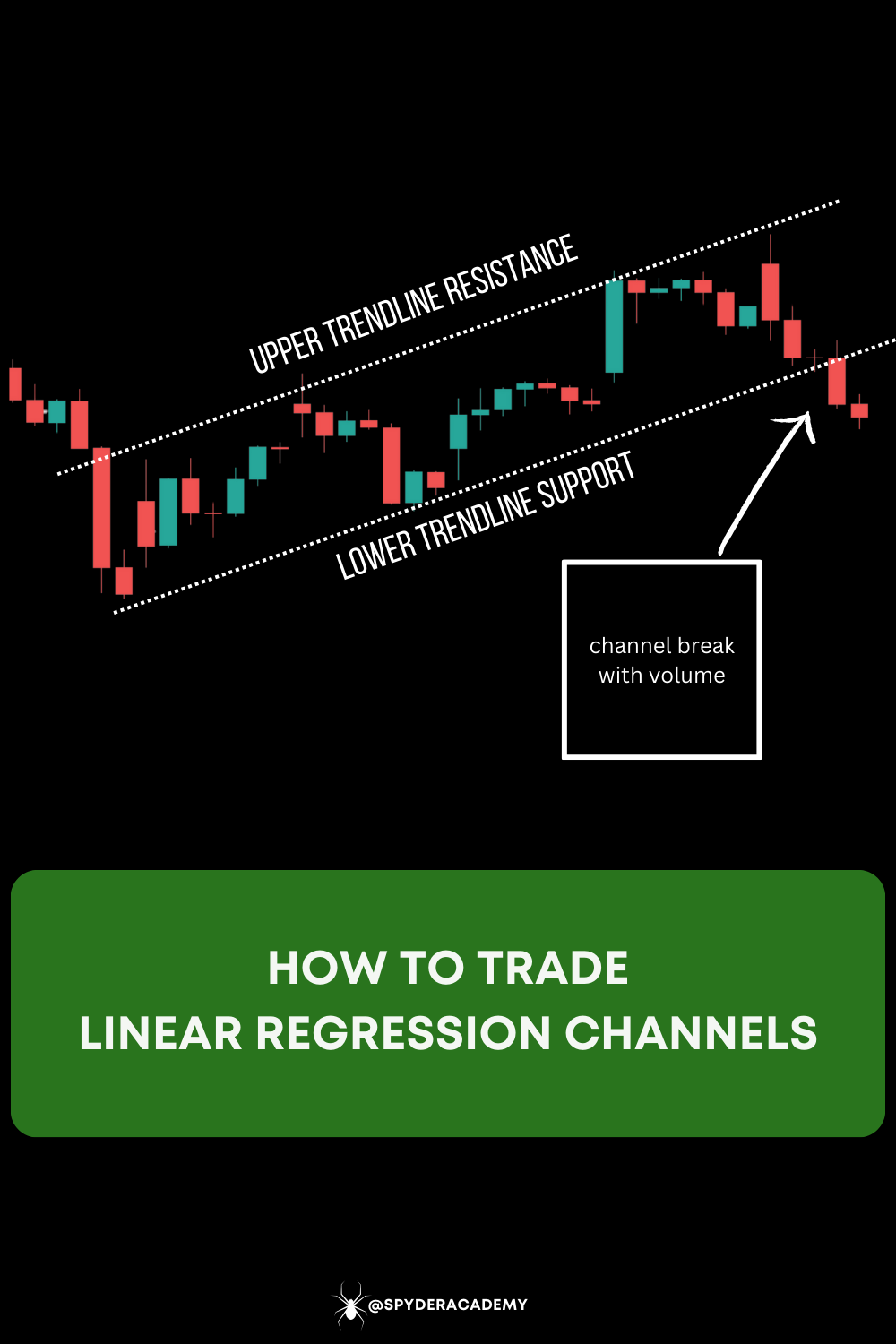

- Technical Analysis: This involves analyzing statistical trends from trading activity, such as price movement and volume.

- Starting Capital: Day trading requires sufficient capital, as Securities and Exchange Commission (SEC) rules require day traders to maintain a minimum of $25,000 in equity.

Essential Tips for Day Trading Beginners

- Start Small: As a beginner, start with a small amount of capital to mitigate potential losses.

- Limit Orders: Use limit orders to have better control over the prices at which your stocks are bought and sold.

- Set Realistic Goals: Understand that not all trades will be profitable, and set realistic expectations.

- Learn from Mistakes: Keep a diary of your trades to learn from your successes and failures.

- Risk Management: Never risk more than a small percentage of your account on a single trade.

Day trading is a challenging yet potentially rewarding aspect of the stock market. As a beginner, it’s crucial to approach it with caution, thorough research, and realistic expectations. With the right strategies and mindset, day trading can be a valuable part of your financial journey.

Are you ready to explore the dynamic world of day trading with the team at Spyder Academy?