Welcome to a deep dive into the world of Options Trading and its hidden language, the Greeks!

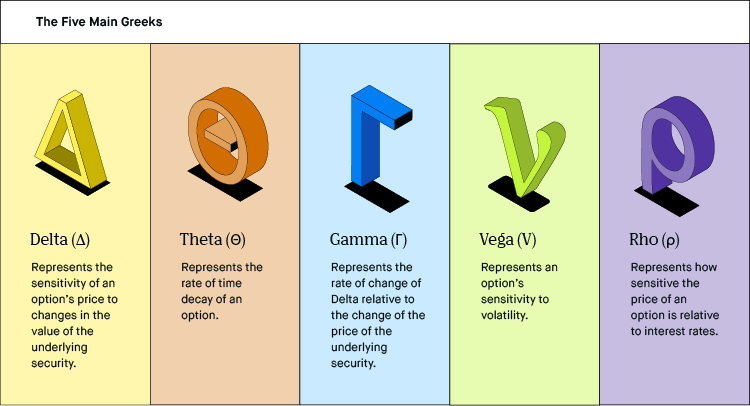

When you hear about Delta, Gamma, Vega, Theta, Rho - it’s not a secret society, it’s financial engineering at its finest.

Get ready to demystify these terms!

What are the Greeks (delta, gamma, theta, vega) and how do they affect option prices?

How to Calculate Greeks in Options Trading

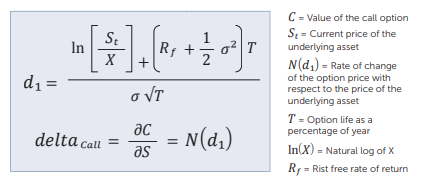

The calculation of Greeks involves using mathematical formulas to quantify the sensitivity of options prices to various factors. Here’s a brief overview of how each Greek is calculated:

1. Delta (Δ)

For call options: Delta = Change in Call Price / Change in Underlying Asset Price

For put options: Delta = Change in Put Price / Change in Underlying Asset Price

2. Gamma (Γ)

Gamma = Change in Delta / Change in Underlying Asset Price

3. Vega (V)

Vega = Change in Call (or Put) Price / Change in Volatility

4. Theta (Θ)

Theta = Change in Call (or Put) Price / Change in Time to Expiration

5. Rho (ρ)

Rho = Change in Call (or Put) Price / Change in Risk-Free Interest Rate

These formulas provide the rate of change of option prices concerning changes in the respective variables. Traders often use these Greeks to manage risk and make more informed decisions in options trading. It’s worth noting that these are theoretical measures, and real-world market conditions may vary.

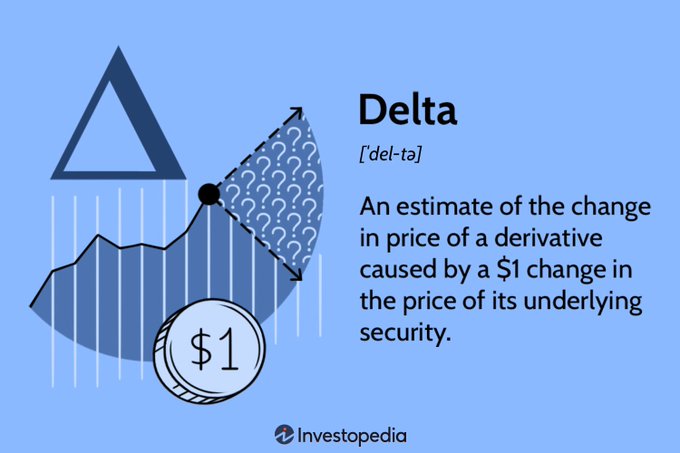

How does Delta affect Option Price

Let’s start with Delta. This Greek measures the sensitivity of an option’s price to changes in the underlying asset price.

Think of it as a prediction - if the stock price changes by $1, Delta tells you how much the option price will move.

For instance, a call option with a Delta of 0.6 will increase in price by 60 cents for every $1 increase in the underlying stock price. Put options, on the other hand, have negative Delta because their value decreases as the stock price increases.

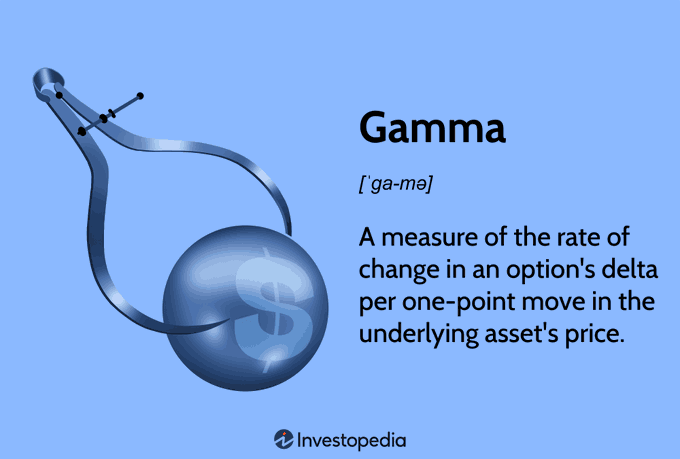

How does Gamma affect Option Price

Next up is Gamma. This is the rate of change of Delta with respect to changes in the underlying price. In simpler terms, Gamma tells us how fast Delta is changing. It’s important because it helps traders manage the risk of large price swings in the underlying asset.

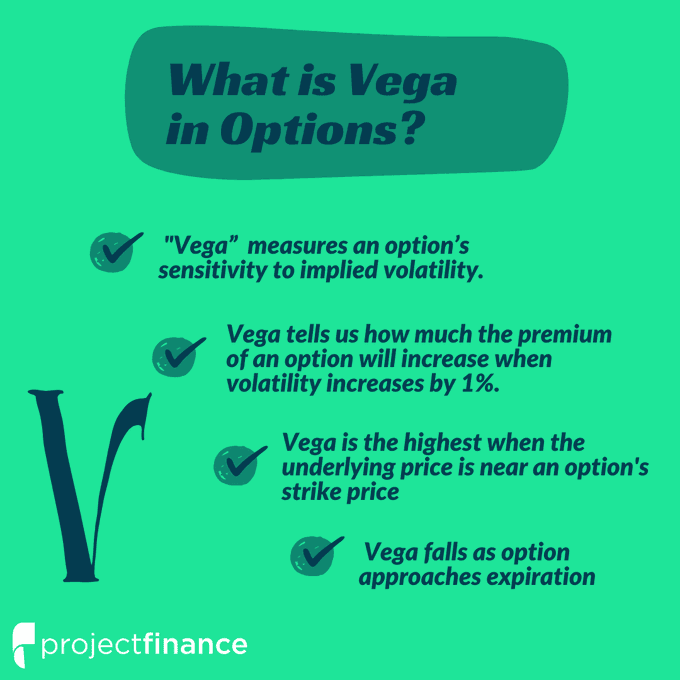

How does Vega affect Option Price

Now onto Vega. Despite not being a real Greek letter, Vega plays a crucial role in options trading. It measures an option’s sensitivity to changes in volatility of the underlying asset. A higher Vega means the option’s price is more sensitive to volatility.

For example, if an option has a Vega of 0.1 and implied volatility increases by 1%, the option’s price will increase by 10 cents. Therefore, Vega is particularly important for traders betting on big price moves, regardless of the direction.

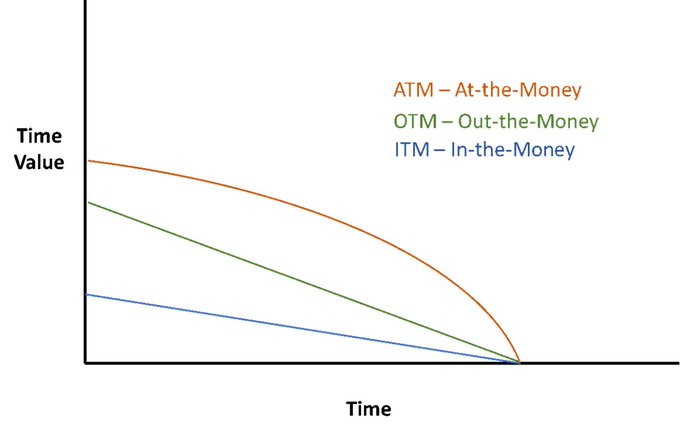

How does Theta affect Option Price

Theta, often referred to as time decay, represents the rate at which the option’s price decreases over time, assuming everything else stays constant. It reflects the fact that options are wasting assets; their value declines as their expiration date gets closer.

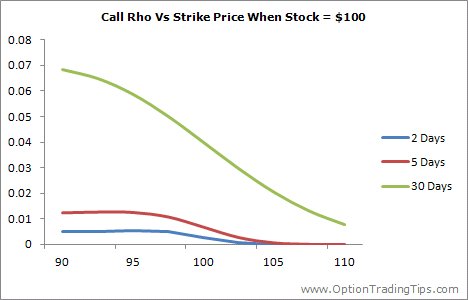

How does Rho affect Option Price

Lastly, we have Rho. This Greek measures the sensitivity of an option’s price to changes in the interest rate. While often overlooked, Rho becomes significant in a changing rate environment. When rates increase, call options typically increase and put options decrease.

Summary

In essence, the Greeks provide a powerful toolkit for managing risk and making informed trading decisions in the world of options. They enable traders to understand and quantify the sensitivity of an option’s price to various factors.

And there you have it - the Greeks of Options Trading, demystified. But remember, while knowledge is power, always be aware of the risks involved in trading options. Always do your homework and remember that the market’s only constant is change itself.