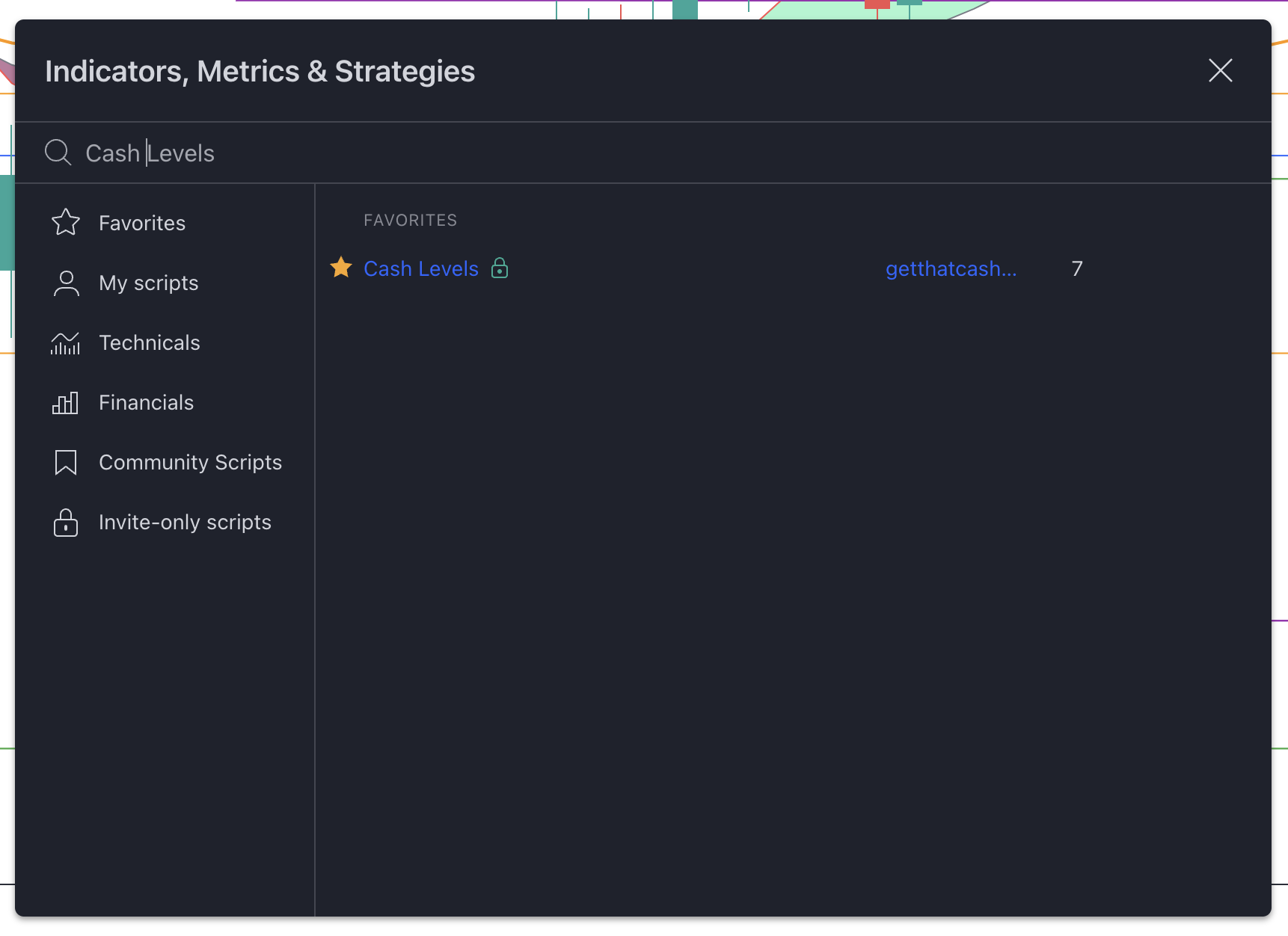

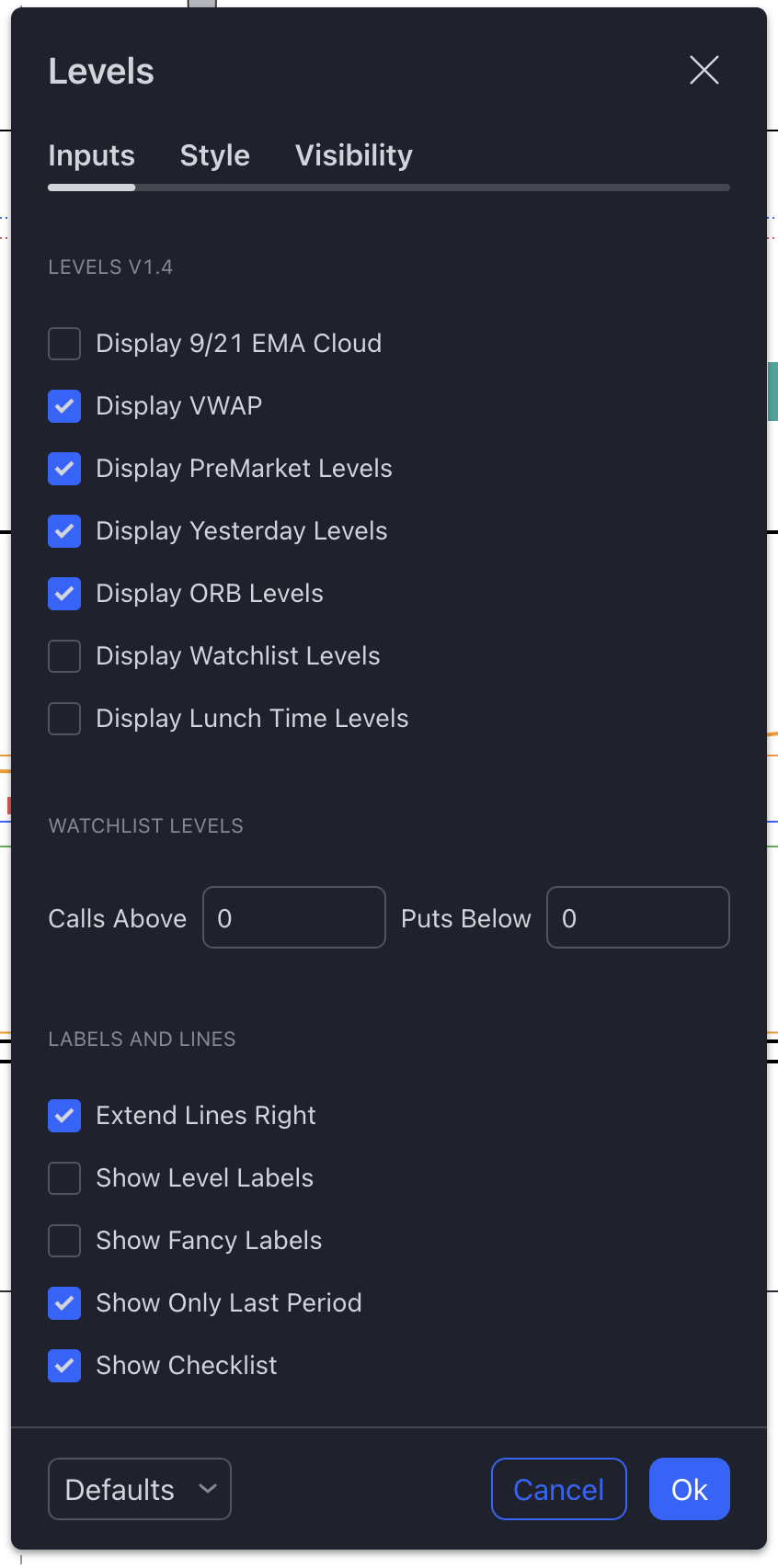

Adding the indicator

As a Spyder Academy student, gaining access to the Key Levels indicator on TradingView is a game-changer. Dive into the Invite Only scripts and, if you’ve recently joined, a quick restart of your TradingView app will reveal the magic.

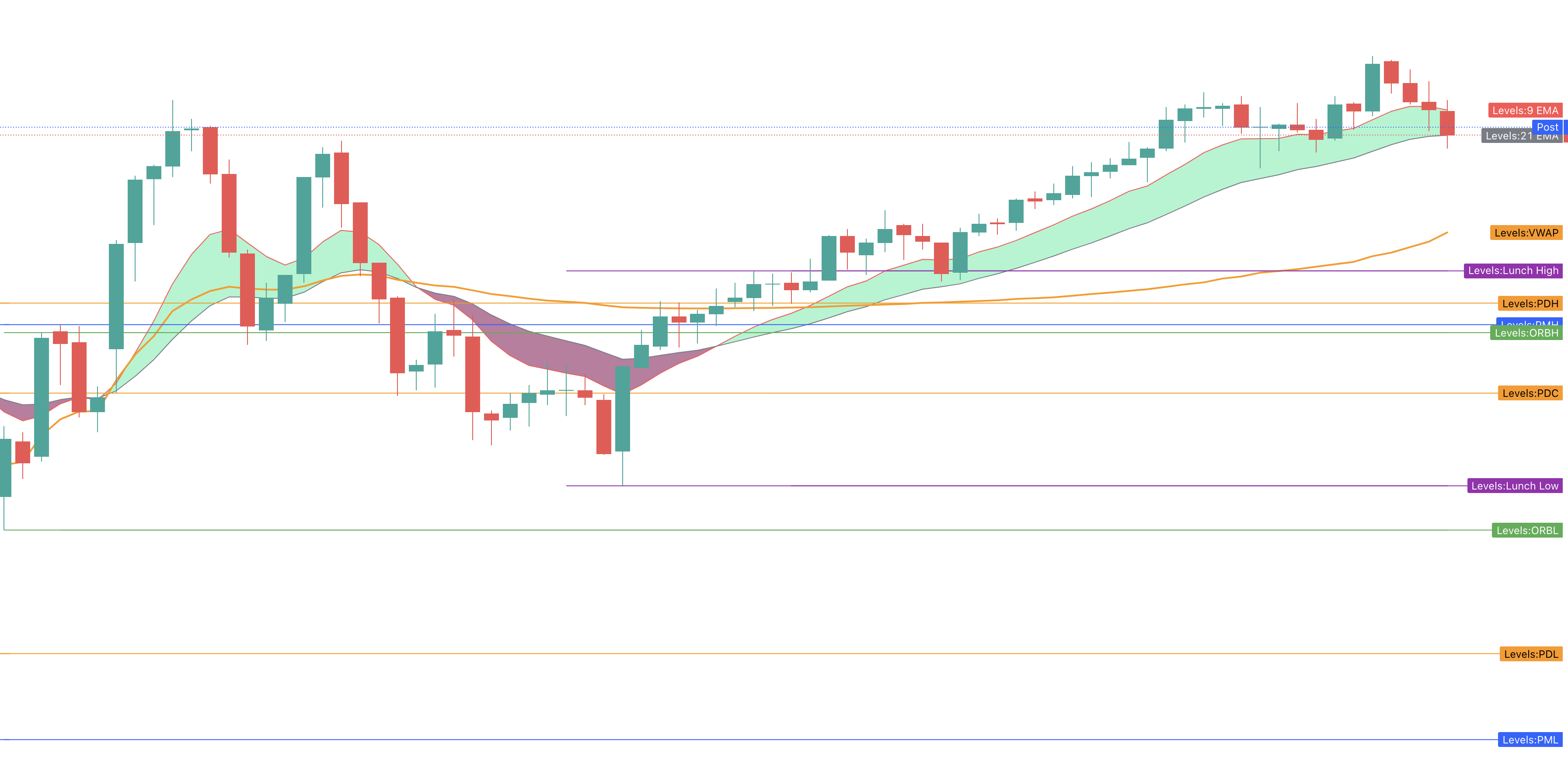

Viewing the Indicator on your chart

Yesterday’s Tale: Highs, Lows, and the Closing Act

Yesterday High (PDH):

Yesterday’s MVP, the Yesterday High, represents the peak market reached the day before. Its significance lies in its role as a psychological level. A break above signals bullish strength, while falling below hints at bearish dominance.

Yesterday Low (PDL):

Counterpart to the PDH, the Yesterday Low is the previous day’s lowest point. A battleground for bulls and bears, breaching below signals bearish sentiment, while holding above indicates bullish strength.

Yesterday Close (PDC):

The Yesterday Close marks the end of the previous day’s drama. A crucial level for traders, it serves as a reference point for potential continuation or reversal cues.

Before the Bell: Pre Market High/Low

Pre Market High (PMH) and Pre Market Low (PML):

These levels, set before the opening bell, offer insights into early sentiment. PMH is the pre-market session’s highest point, and PML is the lowest. Traders pay attention for clues before regular trading hours begin.

Opening Act: Opening Range High/Low

Opening Range High (ORBH) and Opening Range Low (ORBL):

Established within the first 15 minutes, ORBH and ORBL set the initial tone of the day. Breakout above ORBH signals bullish momentum, while breakdown below ORBL hints at bearish activity.

The Lunch Act: LunchTime Range High/Low

Lunch High and Lunch Low:

Between 12 pm and 1 pm ET, as the market grinds into the lunch hour, these levels act as support/resistance in the afternoon session.

Tips for Trading Like a Pro:

-

Intraday Planning:

- Integrate these key levels into your intraday trading plan for potential trade guidance.

-

Confirmation is Key:

- Exercise patience and wait for confirmatory signals before making decisions based on these levels.

-

Dynamic Nature:

- Adapt your strategies based on real-time price action, recognizing the dynamic nature of markets.

Wrapping Up:

There you have it – the key levels that unlock the mysteries of charts. Whether it’s Yesterday’s echoes, Pre-Market whispers, or the Opening Range script, let these levels be your trading compass. Dive into the charts, experiment, and embrace the journey – happy trading, chart whisperers! 📈💼