Are you ready to take your trading game to the next level? Discover the Spyder Academy’s Implied Volatility (IV) command, a powerful tool designed to enhance your understanding of market positioning, especially in anticipation of earnings announcements.

Get The Expected Move

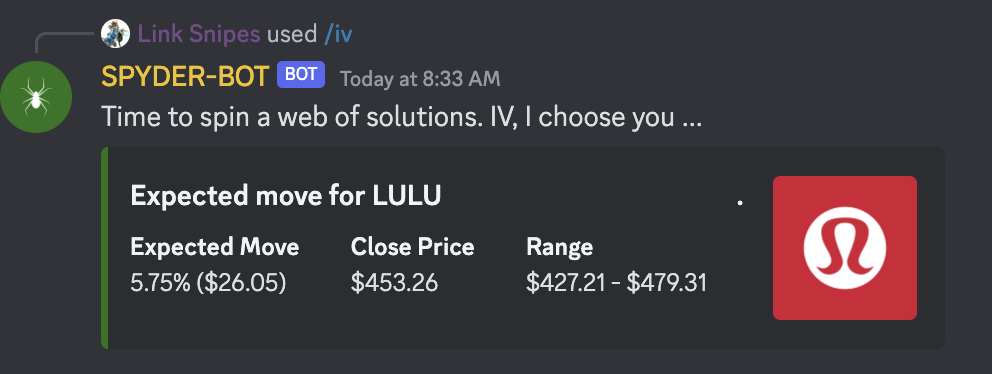

How to Access the Implied Volatility Command on Discord

Not only do you now have access to pull IV on the website, you can also head to our Classroom Discord channel and type /iv TICKER.

The Spyder-Bot will swiftly respond, providing you with the essential information on the expected move for the specified ticker. This invaluable insight is derived from the current market positioning, making it an indispensable resource for traders seeking an edge in the market.

Making Informed Decisions with Expected Move Data

One such strategy that becomes more accessible with this information is the coveted IV Flush Strategy.

Understanding the IV Flush Strategy

Trading the IV Flush strategy involves capitalizing on changes in implied volatility, particularly around significant events like earnings announcements. As the market braces for these pivotal moments, understanding the expected move can guide your decision-making process.

Key Steps to Execute the IV Flush Strategy

1. Invoke the Implied Volatility Command: Use /iv TICKER to fetch the expected move data.

2. Evaluate the Expected Move: Assess the provided information to gauge market sentiment and positioning.

3. Explore the IV Flush Strategy: Dive into the Spyder Academy’s educational material on How To Trade The IV Flush strategy to refine your approach.

Empower your trading journey with the Spyder Academy’s Implied Volatility command. By harnessing the insights provided, you can make more informed decisions, especially when considering advanced strategies like the IV Flush. Elevate your trading acumen and explore new opportunities in the dynamic world of finance.

Stay ahead of the market curve – use the Spyder Academy Implied Volatility command today!